When businesses in New Zealand use Google Ads, one of the most common questions is: does Google Ads charge GST?

In short, yes. From 1st November 2018, Google began charging GST on all New Zealand Ads accounts.

In this blog, we will explore how Google Ads handles GST for New Zealand businesses, explain what this means for your invoices, and provide guidance on managing your tax compliance effectively.

Does Google Ads Charge GST in New Zealand?

To clarify, does Google Ads charge GST in New Zealand? The answer is yes. As of 1st November 2018, Google automatically applies a 15% GST to all New Zealand-based Google Ads accounts. The GST amount is itemised on each invoice.

Explanation of GST in New Zealand

Goods and Services Tax (GST) is a 15% tax levied on most goods and services sold in New Zealand. Businesses registered for GST are required to charge this tax on their sales and can claim back the GST on expenses incurred for business purposes.

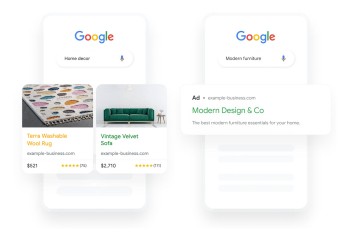

Google Ads Billing Structure

Google is required to charge GST on all Ads accounts in New Zealand(external link). This applies to all businesses using Google Ads for their digital marketing. Google now automatically adds GST to your advertising invoices, ensuring that your business complies with New Zealand tax regulations. This means that New Zealand businesses no longer need to self-assess GST for Google Ads spend, as it is applied directly to invoices.

How to Add Your GST Number in Google Ads

Adding your GST number to your Google Ads account helps ensure that your invoices are correct and simplifies tax reporting. Follow these steps to add your GST number:

- Log in to your Google Ads account.

- Go to the Billing section.

- Click on Settings and select Tax Information.

- Enter your GST number.

- Save your changes.

This process ensures your invoices are compliant with New Zealand’s tax regulations, making it easier to manage your advertising costs.

Claiming GST on Google Ads Spend

New Zealand businesses can claim GST on their Google Ads spend if the advertising costs are incurred as part of their business operations. Since Google automatically charges GST on all ads, claiming it back is a straightforward process. Simply include the GST from your Google Ads invoices in your regular GST returns.

Ensure that you keep accurate records of your invoices, as this will help when you file your GST return and claim back the tax on your advertising spend.

GST on Other Google Services

In addition to Google Ads, other Google services such as Google Cloud(external link) may also be subject to GST. Since November 2018, Google has been applying GST to various services for New Zealand-based businesses. Be sure to check your invoices for other Google services to ensure that GST is applied correctly.

For services like Google Cloud, the process is similar to Google Ads, GST will be automatically applied, and you can claim it back on your tax returns.

Conclusion

Since November 2018, Google Ads has been charging GST on all New Zealand accounts, simplifying the tax compliance process for businesses. While this change reduces the need for self-assessment, it’s important that businesses regularly review their invoices, keep their billing details up to date, and ensure they are claiming back the GST on their advertising expenses.

If you have any questions or need a hand with your Google Ads account the experienced team at Somar Digital can help you manage your existing Ads account or run your digital advertising campaigns on your behalf.